|

|

|

|

Last Updated: Feb 13, 2017 - 1:45:37 AM |

Annual budget contribution by Hon. K. Peter Turnquest, M.P., East Grand Bahama made on 3 May 2015 title, "Real Change for a Better Bahamas" Annual budget contribution by Hon. K. Peter Turnquest, M.P., East Grand Bahama made on 3 May 2015 title, "Real Change for a Better Bahamas"

Mr. Speaker,

How do you build a stronger Bahamas on a shaky foundation, with questionable and incomplete material, no concrete building plans and builders who have demonstrated a disregard for building codes and standards of best practice, unable or unwilling, to submit themselves and their work for inspection? How do we do that Mr. Speaker?

So where do we go from here and what are we to build upon? What does it mean when the Rule of Law appears to be challenged by unsolicited discretionary opinions? When the very fact that conflicting evidence is seen as a deterrent to presenting a case before the court? What are we building upon Mr. Speaker and is that consistent with a Stronger Bahamas?

I don’t know for you Mr. Speaker, but when the Prime Minister spoke about a “Modern Bahamas”, these things came immediately to mind.

Mr. Speaker, where does the ordinary Bahamian fit into this Stronger Bahamas? To me it appears this Government is intent on having a two class system, and if you have not crossed the bar yet, you better hurry up because soon it will be too late. How else do you contemplate the added taxes this government has put on Bahamians and residents, with the laughable offer this year of giving tax relief in the form of lower duty rates on vehicles and bicycles.

Let’s think about this for a minute. How often does the average Bahamian family buy a new or, used car for that matter? Secondly, for those who purchase a new car, what is the percentage that buys a car at the previous top rate of 85% versus the proposed flat rate of 65%? Seems to me, all the Government has done, is to provide a tax break for higher income wage earner who can afford a big or expensive car and the little guy, who may ordinarily buy a car in the lower existing 65% duty class, gets no break at all.

Further, how many low income families can afford a car, even with the so called duty reduction? I don’t see anything here regarding reducing the cost of bus fares or finally creating a unified bus system to make public transportation safe and reliable, or gasoline price reductions such that fares can come down. Indeed, I see instead where the PLP Government is proposing to add a one cent gasoline surcharge tax per gallon on imported fuel instead. Yes, they are proposing more taxes on an already overburdened gas price at the pump. Something is wrong with this Mr. Speaker.

This PLP Administration is once again trying to play a shell game on the Bahamian people. Getting us all excited about the so called reduction in the duty on cars, when the cars most of us could afford were already at the proposed 65% concessionary rate, without telling us that they are increasing the cost of gasoline at the pump, the cost of maintenance and insurance on that car, plus the cost to ship the car to the island on top of all that. I guess that’s why they made bicycles duty free. At the rate they are taxing us and running this country, that may well be all we could afford or maybe that’s part of the new National Health Insurance Plan.

But it does not stop there Mr. Speaker, they also neglected to highlight the fact that there is now a $10 import security fee on every vehicle imported. Why and what is that for Mr. Speaker? They have placed a ban on vehicles over ten years old. Again I ask the question, who is hurt most by that restriction? Do they realize that they are putting many Bahamian businesses out of commission and putting basic car purchases out of the reach of many Bahamian?

Now mind you, as it relates to wrecked cars, I agree 100% with the Government that they ought to be totally banned where it can be demonstrated that the vehicles were damaged in such a way that the structure or safety of the vehicle is compromised. I do not suggest we compromise on that at all though it may hurt some of the body shops. Our people’s lives are more important in this instance.

Mr. Speaker, while the Government brags about bringing down the duty on canned and frozen vegetables, they neglected to say that they have now implemented a security fee on every trailer entering and leaving the Bahamas. $10 each way so that in effect $20 plus VAT has been added to the cost of each shipment beginning July 1st. This will of course have to be passed onto the consumer, so where is the relief?

Mr. Speaker, the Budget presentation is a wonderful booklet, beautifully designed with a nice campaign slogan, offered at the public’s expense by a foreign PR firm specializing in rebuilding the reputations of its clients; as someone put it they are the Olivia Pope of the TV show Scandal. Well done but that has not changed a thing and the Bahamian people get it, there is little in this Budget for them but highly paid for smoke and mirrors. Swing me once, shame on you, swing me twice, shame on me. Don’t be fooled by the New York like slick advertising campaign again Bahamians.

Mr. Speaker, the Prime Minister and Minister of Finance painted a wonderful picture, making promises again, that is undeliverable and at best premature.

He stated, “Our plan is working”. Mr. Speaker, the plan is working for whom?

The most significant claim of success of course, is the claim of reducing the national deficit by two-thirds. Mr. Speaker, I invite Bahamians to help me explain this situation.

If the money you take home every day from your weekly wages is less than the light bill, the rent, the gas, the water and food, how could you afford to get some furniture unless you borrow the money from somewhere? If you already have a loan for say a house, and you borrow more money for the furniture, you owe the man more or less?

Now remember, you en get your asue draw yet, which you counting on to pay something on that house loan, but you think the lady with the first draw is a good Christian lady, so she ga continue to put in her hand even after she get her draw so everybody get their fair share. Maybe but can you hang your hat on that? How many people have been stiffed in these Asues by good Christian people?

They want us to accept that they can continue to borrow year after year, but yet somehow the debt is to come down.

Not going to happen.

It’s that simple. If you spend more than you earn each week, you have to borrow to make up the difference and your total debt goes up. So if this government spends more than it earns and borrows almost $2 Billion dollars in the last three years and their Asue draw (VAT & BahaMar) en come in yet (but she looking good), does it not stand to reason that the overall national deficit is growing and not being reduced as they claim?

|

You see folks, they want to use all kind of technical jargon and tricks to confuse you, to make you feel you can’t understand this high finance, but it really simple. If you add more borrowing and pay back less than you borrowed, your debt is going to go up.

In this case, the debt burden of the Government of the Bahamas has gone from $5,023.10 in March 2014 to $5,645.8 at March 2015 ($6,247.8 at Dec, 2014 per CB), including external debt of $103.8 million, an increase in the debt of $622.7. So what is there to brag about?

Now, the side opposite likes to say that they have rescued this country from fiscal mismanagement in 2012 but I ask the Bahamian people are they better off today than they were in 2012?

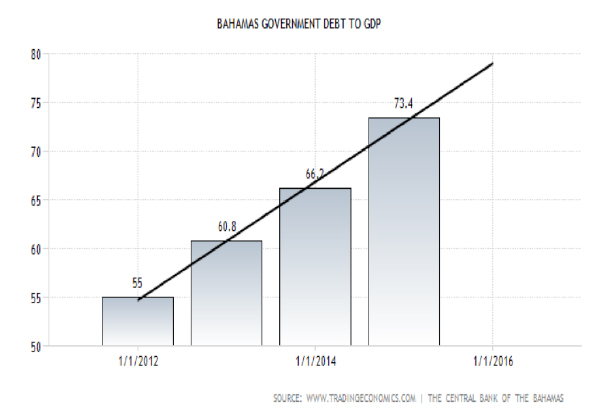

Yes, during the great recession years of 2008 – 2012 (which this Government finally accepts as being a reality) the debt to GDP ratio grew from 40% to 55% (15%). As the Prime Minister puts it in his communication, “As we all know, the global economic and financial crisis had grave and deleterious repercussions on our economy and the employment situation”.

So what was a responsible and caring government to do, and what would the PLP have done during a period when persons were losing their jobs, resulting in mortgage defaults, increasing social problems and an economy spinning out of control? You would expect them to do what every other country did, which was too sure up the economy by engaging in a planned exercise to stimulate employment, while training persons to learn new or improved skills (52 week jobs program), to start new businesses (fresh and jump start programs) and build infrastructure (critical care block, Airport in Nassau and Abaco, NP Road improvement and infrastructure Project, Government complexes in Abaco and Grand Bahama, mini hospitals in Exuma and Abaco, road and dock construction and rehabilitation in other family islands, and the list goes on. Things you can see, feel and touch, you know where your money went).

So yes, they can brag about cutting the spending, they don’t have to, it’s already been done for them and they only need maintain what has been left in place for them.

We were pleasantly surprised to learn that $20 million was being allocated in this budget for a similar jobs training program, which was discontinued by this PLP Administration in 2013, leaving many persons without an income. We trust though, that like the FNM, these jobs will be allocated fairly without regard to political affiliation and to a productive end.

Under the FNM jobs program, many persons were able to turn their experiences into permanent jobs, a testament to the success of the program. We are happy to learn that the program is to be operated under the MOF rather than UR 2.0 for obvious reasons.

But back to the numbers, having inherited a GDP to Debt of 55%, while claiming some sort of success in reducing the deficit as previously debunked, they have taken the country debt ratio to 73.4% (Per Central Bank Annual Report) currently and the year is not done yet! That’s an 18.4% rise in the amount of borrowings in just three short years, and during a period of general recovery in the global and local economy. How do you count that as a success Mr. Speaker?

And while I consider the projections presented for 2016 and 2017 fluff and distractions, we anticipate that the average growth rate will remain relatively flat past this year and the global projections for our debt is expected to increase, unless something changes dramatically. So stop selling dreams about a surplus budget in 2017, most intelligent Bahamians do not believe it.

What they do believe however, is that food prices have increased an average 6.52% according to some economist, since January as a result of VAT and other taxes.

Mr. Speaker, nowhere in the world has it ever been heard or considered acceptable for any Government to claim success in growing government revenue at the expense of poor and middle class Bahamians. Yet Mr. Speaker, that is exactly what this Government has done in this particular Budget communication.

While they seemingly can brag about growing the government revenue through new taxes on the Bahamian people, the citizens and residents of the Bahamas are getting poorer as a result.

Mr. Speaker, I ask reasonable people this question, is this Real Change for a Better Bahamas or is this a short term solution that will result in a growing class of working poor and increasing income disparity between rich and poor?

In his introductory comments, the Prime Minister spoke about assuring that we build a Stronger Bahamas for every Bahamian. He stated in order for that to happen, several forces must converge.

1. We must be responsible Stewarts of our nation’s finances. I believe I have already put doubt to that.

2. We must trust the people, believe in them and listen to their sense of the country’s direction. Mr. Speaker, we have to take a deep breath here. How hypocritical of this government to dare utter these words. It again proves that they have no respect or feelings for the Bahamian people. This is the same government that just the other day delivered a back hand slap to the Bahamian people and totally ignored their expressed collective voices in a fairly taken referendum. This is the same Government who is afraid to present the constitutional amendment referendum or the oil drilling referendum. Believe in Bahamians? This crew? Please!

3. As a warrant of trust, seek to engage all Bahamians. Again, an insult to the intelligence of Bahamians. When we see a fair and equitable awarding of contracts, when we see fair and transparent rulings from Government agencies, full disclosures of information regarding public health risks, when we see accountability, especially when called upon, maybe, maybe, we can talk about trust, but as for right now, with the pathetic record of accountability and openness this administration has, trust is not a word that should be coming from that side.

The Prime Minister spoke about a focus on three core priorities of his Government for the remainder of this term, which we hope will come to a merciful and quick end. A Safer Bahamas, a more Prosperous Bahamas and a Modern Bahamas. Let’s take them on one by one.

Safer Bahamas

The Prime Minister said his Government is building a safer Bahamas by targeting the effective prevention of crime through early intervention, education and swift justice and enforcement.

I need only ask the question, with 64 murders to date, 4 more than last year, do you feel safe? Do you see any evidence of this Safer Bahamas, the Prime Minister speaks of? The Prime Minister speaks of Urban Renewal 2.0 as a jewel in the crown of his crime fighting strategy, has it brought results to date? Has the violence in our neighborhoods decreased? Has youth unemployment decreased? In fact, Bahamian people want to know, where has the in excess of $30 million already spent in UR 2.0 over the last three years GONE! They are asking for an accounting Mr. Speaker but are being frustrated by misguided opinions and administrative stonewalling. So do we feel that we are building a safer Bahamas in the present circumstances, NO!

We have spent an awful lot of money, but uniformed officers are still demotivated, underpaid and made to work in less than ideal circumstances. Crime continues to escalate and illegals and poachers continue to enter and to raid our marine resources, even after spending over $240 million on new boats that were to make the difference. Mr. Speaker, are we better off today?

Building a prosperous Bahamas

There is just so much to say here Mr. Speaker, I don’t know if I have enough time but let’s see, the national debt is growing, unemployment is growing (especially youth unemployment), mortgage arrears is growing, crime is growing and our reputation is falling as a quality jurisdiction for investments. Do you feel better off today than you were in 2012? Do you feel prosperous yet?

The Prime Minister stated in his communication, “When we assumed the mantle of power in 2012, we were under no illusion as to the magnitude of the challenges that our small, proudly independent nation confronted. We faced a dramatic increase in violent crime, and unacceptably high level of unemployment, a dire need for vital public infrastructure across the archipelago, an urgent requirement to transform Government into a modern and efficient administration and an equally pressing need to redress the public finances of the nation and return them to a position of sustainability”.

With an increase in unemployment rate from 14.7% in 2012 when this government came to power, to 15.7% today (before the May 2015 release when we fully expect it to be even higher), with no immediate relief in sight, are you better off Bahamas?

With high energy cost and constant electricity interruptions, water woes and poor maintenance of government buildings and other infrastructure, are you better off today than you were in 2012?

With a drop in the ease of doing business ratings since 2012 and increasing bureaucracy, VAT and other taxes, an erosion in public confidence in the systems of government and the separation of powers between the legislative, executive and judiciary, do you feel the transformation of Government is in your best interest or those in power? Are you better off?

Finally, with an 18.4% increase in the outstanding national debt, do you feel this Government’s urgency in bring our spending under control? Are we as a nation better off today than we were in 2012?

Mr. Speaker, the answer by right thinking Bahamians has to be a resounding NO! This Government has been under performing from day one and has squandered opportunities and new initiatives that could have brought relief to the Bahamian people. By just adding domestic retired consultants alone, they have betrayed the young people who had such hope in this Administration.

The number of foreign consultants and management companies outlined in the Prime Minister’s Communication alone, are a betrayal of the “Believe in Bahamians and Bahamian’s First” mantra used so effectively in the slick NY like 2012 election PR Campaign. Now they are back with Stronger Bahamas, paid for with $3.8 million of public treasury money. Money that could help buy equipment to ease the backlog at the passport office, to fund a start up through the Development Bank, funds that could help build low income housing, funds that could help alleviate suffering and misery of low income Bahamian mothers and children. What a waste!

Customs Modernization

Mr. Speaker, as a stated area of priority and the largest revenue earner for the Government to date, this modernization project has been going on before this administration came to office. What is taking so long Mr. Speaker?

It is noteworthy Mr. Speaker, that in some instances this modernization is becoming a cost hurdle to Bahamian business. Brokers complain that due to congestion during filing of electronic returns, the system often crashes and they are encouraged to file at night.

I had the opportunity to visit one of the straw markets in Freeport last week and one of the complaints was that they now require a broker to file their accompanied baggage with goods for resale. Previously they could clear these goods themselves saving the time and expense of dealing with a broker. So much for progress and the small man takes it on the chin again.

So no, Prime Minister, you may be making the system more efficient, but you are not lowering the cost and increasing the ease of doing business for many local businesses.

Central Revenue Agency

This is a long awaited agency with the potential to significantly increase the efficiency of Government revenue collection and so we applaud the establishment and implementation of the plan to staff the CRA. In the planning however, hopefully the Minister of State for Finance will tell us how staff is being recruited for this agency, the necessary qualification and whether there will be new hires or staff reallocated from within other Ministries. What is the timeline for it to be active?

Private Public Partnerships

Mr. Speaker, the Prime Minister indicated that $200 million has been invested in this year’s budget as seed capital for PPP investments. Mr. Speaker, we often hear the Government speak of PPP as a new concept to the Bahamas but the truth is that such arrangements have existed for some time. BTC is one, NAD is another, the GBPA is a long standing one and there are others. We support the model generally however, we believe and call on the government to ensure that Bahamian individuals and entities are the majority beneficiary of this investment, either through direct engagement, engagement through joint ventures or through skills development.

Cellular Liberalization

Mr. Speaker, on the issue of cellular liberalization something stinks in the Bahamas and it’s not the conch.

What exactly does the Prime Minister mean when he stated that the liberalization process has experienced some inconsequential delays? Inconsequential to who, The Government, Cable & Wireless or the Bahamian people? I suspect the delay is consequential to our constituents as they are made to endure high cellular bills and inconsistent service. Why did Digicel Bahamas Limited withdraw? What “developments have led URCA, in consultation with the Task Force and their advisors, to extend its deliberations to ensure that the integrity of the selection process is preserved”?

What are you trying to tell us Prime Minister, speak plainly so everyone can understand this delay which results in them continuing to have to bear with under performing service, is there a problem with the integrity of the process?

We wonder whether the withdrawal of Digicel, who for more than a decade made it know they wanted to enter our telecommunications market, as well as the long drawn out BEC RFP process, may have soured the taste of investors in PPP towards this administration.

While we are on the subject of BTC, I trust that during the course of the debate, the government will advise this House on the status of the BTC foundation that is to hold the 2% economic interest in trust for the Bahamian people. Has the foundation been formed and capitalized? Is there a Board of directors and officers of the foundation? Who manages the activities of the foundation? What income has been earned and what expenses have been incurred?

Mr. Speaker unfortunately, this Budget does not speak to ICT sector policy or development of this sector as a potentially lucrative area for investment. Unfortunate!

We propose the specific attention to be given to this area as is financial services, to develop and promote ICT and the potential it holds to grow and diversify the economy.

Energy Reform

Mr. Speaker, this one continues to baffle me honestly. To accept that Bahamians cannot even manage a monopoly institution in 2015 is a sad failure and indictment of this Government and every Government since independence. Of course, I am of the opinion and I have stated in this House before that I categorically reject that thinking and in fact fully believe that if left to manage the institution as professionals, the existing management of BEC would do a fine job of restructuring and turning this entity around.

I know some of them and they are qualified professionals in various disciplines, so don’t tell me that we need foreigners to manage BEC. It is unacceptable in 2015.

Is this what you meant by “Bahamians First”? Is this the Stronger Bahamas you want for us? Incredible!

The Government will appoint five members to the Board of the restructured BEC and Power Secure will appoint two. I may be a little slow Mr. Speaker but tell me, with the majority of decision makers being appointed by the Government, what is going to be different at BEC?

But Power Secure is negotiating a 5 year management contract. I understand this company is a transmission and distribution company with little to no experience in public utility generation. Bahamians, do we have a T&D problem or a generation problem? The NAD model for BEC only adds cost to an already high, unreliable BEC. Generation is where the issues and costs are and should be the primary focus, so how does Power Secure help us, Mr. Speaker?

Together with the debt reduction surcharge planned, I see higher bills for Bahamians and further inflexibility from the corporation. Sir Lynden Pindling must be turning over in his grave, because I am sure he did not intend for us to further lose control to foreigners or anyone else. He would not have expected his PLP to be the ones to place oppressive taxes and to increase necessary utility costs on the backs of his people. Marco City is right, this is not the PLP Party of Pindling!

The PM’s silence on the target rate per kilowatt hour was quite loud. We note, that in Jamaica where two (190 megawatt the other 140 megawatt) power plants will come online in the first quarter of 2017, they will be supplying energy to the grid at $0.13 per kilowatt hour. I can only hope, given the VAT revenue projections, that the Minister of Works will announce that Bahamians can expect that their electricity bill to drop to around $0.20 per kilowatt hour as a result of this exercise.

BAMSI

Another boondoggle that will cost the Bahamian people millions for years to come. Mr. Speaker, I leave this for others to explore but I would only ask, when will the commercial farm begin to pay back the Bahamian people for its investment? When will the burnt Building be reconstructed and who will pay for it. I see an allocation of $14 million in the capital budget for BAMSI, are we paying for this building again at an increased or inflated cost? What has been the real spend on BAMSI?

I note the Prime Minister’s words, “we must do all that is possible, through joint venturing, to ensure that the commercial side of BAMSI is self-sustaining”. An interesting choice of words Mr. Speaker considering BMSI, if ever successful will displace farmers throughout the Bahamas but particularly in North Andros.

Creation of Creative and Cultural Industries

Mr. Speaker, scouring the 2014/15 Budget, I did not see a provision for the

Junkanoo Carnival and it struck me as odd because we spent a reported $9 million on that venture. Which budget did that come from Mr. Speaker?

Be that as it may for now, looking at the current budget, I noted a new allocation of $3 million for a

National cultural Festival. Is this the same as Junkanoo Carnival? But more importantly, I noticed that the contribution to Junkanoo is flat at $1.5 million. With Carnival having a budget of $9 million compared to this Junkanoo budget, we see where the Government’s priorities truly are despite the proclamations from various individuals. Mr. Speaker, the junkanoo artists deserve more respect for having created and maintained this special cultural event for so long. Each major group should be provided with a working shack with space for display of completed costumes, to serve as tourism product to be included on a tour as they do with the Samba bands in Brazil. Each Group Leader should be given a stipend, like our elite athletes so that they can focus on the craft and organizing the participants. This is a tremendous job Mr. Speaker, and honestly I don’t know how they do it. They deserve our support and promotion and I am speaking of all A Groups, including those in Grand Bahama and the family islands without prejudice. We must support and protect our own heritage. Now that Carnival has sucked out all of the sponsorship money from the economy, this support is even more necessary.

Mr. Speaker, the Junkanoo Carnival and the IAAF Relays appear to have been a success in terms of attendance. I will give the Government that much but were they a success in achieving their stated objectives? That is the question that all of us need answered in order to support this initiative. On the face of it, the business planning appears to have fallen short. There were no additional heads in beds, there were no increased visitors, and there was no significant economic stimulus for vendors as evidenced by the rumors of refunds to vendors of booth rental fees and compensation of lost anticipated profits, an incredibly generous offer by Mr. Major, et al, with money that does not belong to them.

One of the most egregious items I think though Mr. Speaker, is the several artists who performed and won prizes but have not been able to receive their compensation. What does the accounting for the event (which is now late anyhow), have to do with the prize money promised and owed to the Bahamian artist that performed so well? This is scandalous and shameful and must be rectified immediately. You have had your party and the musicians have played their tune, now it’s time to pay up! Pay UP Mr. Major, Mr. Dames, Mr. Fields, and Mr. Munnings! Protect your reputation and that of this new $9 million venture.

As we said, at the inception, we will await the reports before we pass judgment on these events, but we await the reports from last year’s relays. We need to know where $9 million of the tax payers VAT money was spent. We need a detailed accounting, independently verified to protect the integrity of the venture.

Gaming Industry

Mr. Speaker, the Gaming industry has been legitimized despite the protestation of the majority of Bahamians who had an opinion on the matter. Those same Bahamians will have a say in 2017 or before, and they will be reminded of the breach of trust and betrayal that resulted. Nonetheless, we are now faced with a dilemma regarding how to manage this industry, specifically as it relates to the banking of proceeds.

Mr. Speaker, given the circumstances, I am amazed by the way this has been approached. If as outlined in the legislation, the compliance regime is in place and monitored, I am of the view that the domestic gaming industry ought to have the same privilege as the foreign owned gaming houses. Why should the Bahamians be treated any differently? Why should they be taxed more than the foreign owned entities, while not being allowed to access those same foreign dollars through international play? This has to be discriminatory and cannot stand. Right is right Mr. Speaker and this PLP Government has allowed the horse to bolt the gate, so we might as well saddle him and ride him for what it’s worth.

Mr. Speaker, equally as egregious I think, is the provision in the law that prohibits mobile hand held PDA devices from being used in the gaming technology platform. Many Bahamians supported their families through contracting these devices and have now been put out of business. We must be able to use the same technology to secure the revenue so gained and facilitate these individuals in gainful employment.

I note that gaming taxes from this sector is now reduced to $20 million. What a difference from the $40 - $140 million promoted during the debate.

Financial Services

Over the last three years, we have seen contractions and alignments in the domestic and off shore financial services industry. This represents solid middle income jobs and thus puts this already stressed class at risk. We must continue to do all that we can to protect and promote this industry in a proactive way, with improved service, ease of doing business and creative and innovative products such as the ICON. We must also look at the license fees charged to this sector to ensure that we are not pricing ourselves out of the market and that we are not causing additional burden on local consumers through the passing down of increased license fees and taxes. $15 to cash a cheque, VAT on services and other fees is a pass through attempt by Banks to recoup this license fee increase and legislation needs to be drafted to ensure that the intended effect of the increased fees is not put to the consumer.

It would have been good had the PM elaborated more on how his administration would have created or breathe life into the entrepreneurial spirit of young Bahamians and add to the expansion of financial services.

Road Traffic

Mr. Speaker, this is one of these quality of life issues that really do not take much to remedy. I took note of the contract signing for software and consulting services from another foreign firm (Believe in Bahamians), for a reported $8 million, twice the original anticipated cost. I am sure the Minister responsible will explain what we are to get with that extraordinary cost, but I do hope that it will at least do away with the existing paper license disk with all of your home information and a new driver’s license with Biometric data and your personal home address so that it can be used as a proper piece of identification.

Mortgage Relief

Again, enough already with this fantasy, facilitate job creation and the problem is solved. I am tired of hearing about it and I am sure the Bahamian people are too. Promises are a comfort to a fool and thankfully, there are fewer and fewer of those these days.

While the Government talks about relief, it is further compounding the mortgage problem by extracting VAT Revenue generated on the backs of the unemployed, the poor, and struggling loan clients of financial institutions who are unable to meet there commitments on a timely basis as evident by the Central Bank's statistics on delinquencies. Clearly, the glee the Ministers’ of Finance have is not what every day Bahamians feel for VAT. Everyday Bahamians are calling the various talk shows, and they are saying basically in the words of Michael Jackson, "they don't really care about us".

But we care; we would have followed the advice of the New Zealand expertise and not put VAT on financial service. This same advice is being followed in Barbados where there is no VAT on financial services. Domestic Financial Service and Sales Tax has been repealed in the Turks, yet we prefer to help erode individual’s equity in their assets so that should the bank move to sell an individual's asset, they stand to collect little to nothing. This government would rather us all be homeless and collecting social services benefits.

This brings me to the subject of BOB, who are the shareholders of Resolve Bahamas? Maybe the member of Fox Hill, will advise whether a resolution of parliament is required to form Resolve Bahamas? That aside, in the earlier years of this century, there was a company in the US called Enron. It was once an energy giant, thanks to these special purpose vehicles (SPV’s) which this Administration seems to be as fond of as flies to a cow's behind.

We all know the SPV helped Enron turn bad debt miraculously into revenue. So, the Ministers’ of Finance will know no one is fooled, and the BOB $100 million facility is a direct liability of the government, and so will the $470 million for BEC legacy debt. As long as the government continues to own BEC it will remain a liability of the government.

Clico

Mr. Speaker, I must also speak for the people invested in Clico. Mr. Speaker, frequently I receive call or visits to my office from Clico policy and annuity holders wondering what is happening with their investment. Mr. Speaker, it is hard to hear retired persons especially, having invested most if not all of their retirement funds in Clico, only to be left with nothing after the failure on government’s part to protect their interest. Mr. Speaker, I call upon this Government once again, to move to protect and ensure the full repayment of the funds invested in Clico by hardworking, responsible citizens. If we can spend $9 million on Carnival and $3.8 million to advertise a fantasy of achievements, then we must be able to find the money to make these Bahamians whole. Just do it!

Building a Modern Bahamas

Once again we applaud the government for taking the FNM’s advice to phase in NHI over a period so as to allow for improvements to the delivery system and the absorption of the cost. I don’t know why the PLP has to be so stubborn all the time and kick and scream before they just accept good advice. Others will deal with the substance of the debate on this line item so I will not go into this, only to note that to believe you can establish this program with no new funding, is going to be an interesting study in creative financial modeling. Good luck!

Economic Environment

Mr. Speaker, the Prime Minister must have simply forgot that he presented most of these resort development projects outlined in his communication last year and the year before that. These are not new announcements and they show no diversification in FDI, all being tourism related. What happens when Cuba becomes a bigger player or heaven forbid there is another major economic event? Our eggs are still in one basket and we don’t even own the basket! We must do better at creating a diversified investment strategy so as to spread the risk.

Some of these projects announced are not even finalized as yet, negotiations continue and others are just that, pending. Again the unbridled penchant to announce projects before they are finalized is astounding and yet, we are to buy into the rhetoric. Shovels in the ground people, shovels in the ground., This has become the mantra in Grand Bahama for years as we have seen so many promised developments fizzle but I believe the rest of the Bahamas is beginning to catch on. Shovels in the ground.

We note the delay in Baha Mar operation, which has left a serious concern for the continued recover of the economy, the projections made and on unemployment numbers in the short term. The PM mentioned projects in East Grand Bahama, and we are excited for the possible developments but yet again, the ink has not been spilled on these potential arrangements and so it is incredibly early on to be announcing them and raising the expectation of my people, unless….you are about to call an election?

Fiscal Performance 2014/15

Mr. Speaker, I note with regret that the Government has made a number of transfers between lines again in this Budget but more disturbing is the commission of Schedules 26 & 27, which lay out the movements in debt principal and interest repayments, leaving one to wonder, why?

Mr. Speaker, I noted two things that are significant in the Prime Minister’s communication regarding the 2014/15 fiscal performance analysis. Rather than analyses his own administration ‘s performance or, even to compare that performance to the date he took over, he sort to compare this year’s performance to 2007/08, when as he has earlier acknowledged the global recession began. Why would he do that Mr. Speaker, is he intentionally trying to mislead the Bahamian people on their performance over the last three years?

Secondly, in his concluding remarks in this section he make this statement, and listen carefully, “We now ESTIMATE, Mr. Speaker, that the total Government debt at the end of 2014/15 will amount to $5,356 million, down $88 million from last year’s BUDGET FORECAST of $5,444 million.”

Did you catch it? First, he speaks about an estimated outturn, it’s not real or to put it straight, as this administration is oft to do, he is taking credit for an outturn that has not yet happened.

I remind you of the many unfulfilled promises in the Charter of Governance and ask the Bahamian people to make a judgment if we should rely on that.

Note the difference between what was actually borrowed over the last three years and the budget allocation:

1. 2012/2013 - $555 million (approved budget $512.2 million),

2. 2013/2014 - $582.5 million (approved budget $465.8 million)

3. So far for 2014/2015 - $478.4 million (approved budget $343.2 million).

As a result, in the last three years we have come to expect that what this PM and Minister of Finance says and puts on paper doesn’t jive with reality. This budget is pure “smoke and mirrors”

Secondly, he compares the estimated debt, not to the previous year actual numbers, but rather to his BUDGET or ESTIMATE for this year. In other words, last year they made a guess of what government debt will be and this year he wants us to accept his new guess at the debt and compare the two as success; compare two estimates…Really?

Mr. Speaker, the Central Bank in its contribution to this Budget stated in respect to the national debt, “The direct charge on the Government GREW by $616.2 million (12.4%) to $5,599.7 million in 2014, extending the $583.6 million (13.3%) growth in the prior year. Bahamian dollar debt, at an estimated 71.6% of the total, advanced by $339 Million (9.2%) to $4,009.7 Million, while the total foreign currency credit expanded by $277, 2 million (21.1%) to $1,590 million.

Government’s contingent liabilities increased by $46.9 million (7.8%) to $648.1 million at end December, a reversal from a slight $2.1 million (0.4%) decline to $601.2 million in 2013, reflecting mainly gains in the outstanding obligations of two entities.

As a result of these developments, the National Debt expanded by 11.9% ($663.1 million) to $6,247.8 million at end December 2014, following an 11.6% ($581.5 million) increase in the previous year.”

That’s the facts Mr. Speaker, no spin, as reported by the Central Bank of the Bahamas.

In the outlook, the project growth rate of 2.6% is overly optimistic with the US economy sputtering and actually declining in the first quarter of this year and a delayed Baha Mar opening. The projected debt redemption is also questionable given that even in the great years of 2002 – 2007; we were unable to achieve this level of debt repayment.

Mr. Speaker, I have already put the case that the claim of reducing the debt is truly misleading but to reiterate, the Bahamas debt to GDP ratio has increased by 18.4% since 2012 and has not been reduced as is being claimed, year on year. Their assessment is a complete fallacy.

Recurrent Revenue

Mr. Speaker according to the Budget presented, recurrent revenue has increased owing primarily to VAT, but it is interesting to note that on an expected outturn of $150M for the half year to June 2014, which when annualized amounts to approximately $300M, the Government miraculously projects that VAT income for 2015/16 will jump to $545M. If we were to attribute part of that increase to the addition of VAT on insurance premiums to be taxed come July 1st, you still cannot get there.

I am sure the Minister of State will explain it to us but I suspect, it will be much like Line 27 of the Revenue Summary, where they show proceeds from borrowing from July 2014 to March 2015 of $486M but yet the approved annualized estimates show only $381M. If I lend you $100 in January and how can you say I only lend you $75 in May? Did you borrow the $100 or not? UNBELIEVABLE!

Recurrent Expenditure

Mr. Speaker, contrary to the impression being given by the Government, recurrent expenditure has not been coming down and is set to increase again 2015/16. In fact the recurrent expenditure has increased from $1,721M in 2012/13, to $1,823M projected in the current year to $2,098 in 2015/16. So how are we containing expenditure? How does this Government measure success?

Revenue Measures

Mr. Speaker, the Government announced a number of supposed revenue measures to pay dividends on VAT implementation or to bring relief, as they put it to the Bahamian People. Mr. Speaker, as always we have to pay close attention to what this Government says and does not say.

The reduction in the business license fee of .25% is a good start but I recommend that the rate be further slashed to 1% to compensate for the VAT component as originally contemplated in the implementation proposal. This will be real relief to many low margin businesses in particular as it should never be the Government’s intent to drive a business into cash flow loss by taxing it on top line revenue without regard to the cost to produce that revenue.

The reduction of stamp tax to 2.5% is a good move however, this saving will not be realized by consumers. Whereas previously buyers and sellers of property would split the stamp tax 50/50, with the seller paying 5% and the buyer the other 5%, under this proposal, the buyer will now pay a minimum of 8.75% (1.25% Stamp tax + 7.5% VAT). So is this real relief? Bahamas you be the judge.

The Way Forward

Mr. Speaker, I have given some clues as to the way forward under an FNM administration. To be clear however, with respect to VAT, we intend to bring real relief and not to play with the emotions of Bahamians as this Government is doing.

While the Government brags about the tax revenue generated at the expense of the poor and working class Bahamian through their regressive tax hikes, the cost of living for all “Bahamians and residents has increased, even while high unemployment or under-employment and the daily suffering of our citizenry persists and continues to escalate.

The public would recall that the Leader of the Opposition has called upon this PLP Government not to implement any tax that will be unduly burdensome to the poor or cause them to carry a disproportionate share of the tax burden. We consider VAT on electricity, gasoline, private health care and basic food items regressive and an unfair burden on the poor. It raises the question of accountability and fairness in tax policy.

The PLP in contrast to our position said that Bahamians are UNDERTAXED and have thus sort to reach deeper into the pocket of the poor and middle-class for even more of the money they have worked hard and saved for their families and future aspirations.

The PLP said they are for Bahamians...but they refuse to be accountable to Bahamians. The PLP said they believe in Bahamians....but can Bahamians believe in the PLP? You shall know them by their deeds and this PLP Government has thus shown that they are only for rich Bahamians, their friends and colleagues.

Grand Bahama

Mr. Speaker, I could not close without speaking directly to my constituents and to Grand Bahama. Mr. Speaker, despite promises and even several town meetings where the promises were repeated, the Government has yet to come true for Grand Bahamians.

Mr. Speaker, in the 2014/15 budget, funding was allocated for a fire station in Grand Bahama ($2M), for a Sea Defense System in Smith Point ($2M) and for a Fishing Hole Bridge ($7M). What happened to that money Mr. Speaker? I have shown earlier that the money was borrowed and allocated in the previous Budget specifically for that purpose, so where is the money Mr. Speaker? We note that a contract was signed for the fire station just last week but the remainder of the work is not done and there seems to be more talk but no action. The people of Grand Bahama want to know when these projects will be done, no more.

Mr. Speaker, despite the increase in air lift and the opening of Memories, the economy of Grand Bahama continues to struggle. Things are bad Mr. Speaker but we are a unique people and we continue to fight. The prospects are difficult to comprehend but we have opportunities which I have urged the Hawksbill Creek Committee to pursue.

Specifically, to use this moment to encourage greater participation by domestic investors through greater incentives in collaboration with the GBPA. Consideration of the voluntary separation of the regulatory arm of the GBPA from its operating entity and allow those powers to be vested in a true local government, with the power to tax and offer incentives like most modern states or cities in the USA. Encourage development of the Northern Bahamas COB campus, with specific programs to attract domestic and international students, facilitate the creation of more beach front parks and parks in general, lower arrival and departure fees and aviation fuel cost at the airport. These are just a few examples of what should be advanced.

Freeport is a unique creature and an asset that we have fought hard to destroy since the Bend or Break speech. I encourage the Government to stop fighting the tide of Grand Bahama and free trade zones in particular and instead exploit its potential and shamelessly promote and support it.

Encourage the GBPA and Hutchinson to believe and invest in their product so that others will be encouraged to invest and believe in our product.

Conclusion

Mr. Speaker, the Government of the Bahamas must not only listen to the voice of Bahamians but they must act according to that voice and their priorities. This budget does not reflect those priorities and does not match up with the rhetoric. It does not reflect a Stronger Bahamas and it does not represent Real Change for A Better Bahamas. I simply ask the Bahamian people, are you better off today than you were in 2012? Can you see where almost $2 billion has been spent to benefit you? Are you safer? Are you more prosperous? Do you feel your Government is operating in a modern, transparent and accountable manner? If the answer is NO, be encouraged, Real Chance for a Better Bahamas is coming!

© Copyright 2015 by thebahamasweekly.com

Top of Page

|

|

|

|