|

|

|

|

Last Updated: Feb 13, 2017 - 1:45:37 AM |

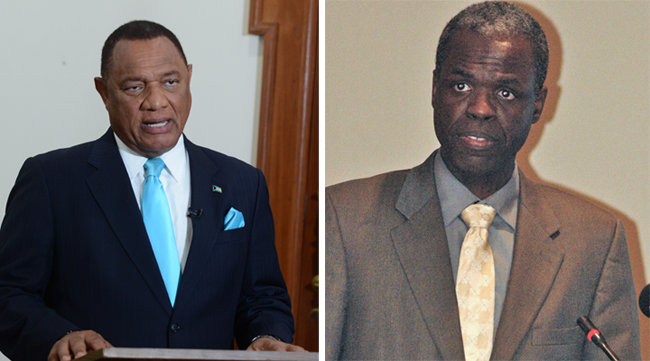

Person of the Year shared between the Rt. Hon. Perry G. Christie (left) and John Rolle (right).

|

The fiscal affairs of The Bahamas government were a matter of grave concern of most Bahamians in 2015. Hence, the introduction of Value Added Tax (VAT) undoubtedly was the most important fiscal intervention on the part of any government in the national economy for decades.

As a consequence, this year the management of The Jones Communications Network (JCN) decided that its Person of the Year Award for 2015 should be jointly awarded to Prime Minister, the Right Honourable Perry G. Christie who developed the political will to introduce VAT and to the Financial Secretary of the Bahamas John Rolle who was responsible for its smooth implementation and administration.

In making the announcement JCN Chief Executive Officer Wendall Jones said, “Politicians and Civil Servants are not normally credited or publically recognized for their excellence in public service, but so significant were the fiscal reforms for the country’s economic resurgence, and so efficiently and competently executed were these initiatives, that the JCN Civil Society and Person of the Year Awards Committee thought that it is fitting to jointly recognize The Minister of Finance and his Financial Secretary as our 2015 Persons of the Year.”

The national debt had expanded by some two billion dollars or 40% in just 5 years; the annual fiscal deficit had exceed one half billion dollars; government revenue performance had deteriorated by some three hundred million dollars annually and the government’s bank overdraft stood at another several hundred million dollars. A dismal and bleak picture of public finances by any standard but such was the case as reported by the incoming Christie administration in May 2012. There was no fiscal headroom said the incoming government.

This state of affairs would require a level of borrowing that was unsustainable said the government and if the fiscal problem was ignored, the levels of borrowings and debt would go on unchecked and the burden of debt would grow to very dangerous levels.

The government was tasked with putting the burden of debt on a downward path to more sustainable and manageable levels, recreating the necessary fiscal head room to finance the full complement of the country’s national development plans, including economic renewal and stronger job creation. The government targeted a downward movement of the national debt by FY2016/2017.

In response the government articulated what it called a medium term Fiscal Consolidation Plan that the State Minister for Finance characterized as “measured, balanced and targeted, aimed at achieving a broad range of mutually reinforcing objectives.” For example:

- Putting the public finances on a solid and sustainable footing for the long haul;

- Transforming Government into a modern administration that provides public services efficiently and responsively to the needs of our citizens;

- The lynchpin of the package of fiscal reform and revenue enhancing measures was tax reform in the name of Value Added Tax (VAT).

The government also incorporated into its plan “a number of intermediate, operational targets for the key components of the public finances.” They are as follow:

- A reduction in the ratio of Recurrent Expenditure to GDP of at least 2 percentage points from the estimate in the 2012/13 Budget to FY 2016/17;

- A reduction in the ratio of Capital Expenditure to GDP, from its recent peak of almost 5 per cent to the more traditional level of 3 per cent; and;

- An increase in the ratio of Recurrent Revenue to GDP of well over 4 percentage points by FY 2016/17. That will take public revenue yield “from an unacceptably low level to a one that is more in line with that in other nations in the region, though still below it.”

Having established its fiscal policy, the government appointed Mr. John A. Rolle, a central banker, to the post of Financial Secretary with the responsibility for executing the minute details – the nuts and bolts if you will – of the government’s new fiscal policy or what it called its medium term Fiscal Consolidation Plan. Mr. Rolle superintended the reform initiatives, overseeing the implementation of Value Added Tax in January 2015 and the government reported that revenues generated from VAT exceeded expectations, allowing the government to reduce its budget deficit by 60% by the end of the 2014/2015 fiscal year, ahead of target. He also established the Department of Inland Revenue.

It is important to note that the financing of the first phase of the National Health Insurance (NHI) scheme was made possible in no small part to VAT, which the government forecasts to exceed initial estimates of three hundred million dollars in the 2015/2016 fiscal year.

Later this week, JCN will announce the Businessman of the Year for 2015 and winners for the awards of Sports and Civics. The awards will be presented in a gala luncheon on Friday 22nd January 2016 at The British Colonial Hilton Hotel.

© Copyright 2015 by thebahamasweekly.com

Top of Page

|

|

|

|